I'm pretty young(in my opinion) to be thinking about investing, but honestly, I feel that the earlier you make a smart choice, the earlier it can come back to help you. Over the summer I recently invested a good amount of money(from my perspective) into the Stock Market for Nintendo. And now, I really want a new hobby or thing to do, so I came and mixed two things that I find interesting/worthwhile. Still need to get approval from my parents to do it(I'm only 16), but I want to collect Limited Edition 3DS systems. I love just looking at all the designs and my hope is that I'll be able to turn that into profit after selling them in years to come. Since I did not find a thread relating to this already created, let us discuss investing in Nintendo!

-

Welcome to Smogon! Take a moment to read the Introduction to Smogon for a run-down on everything Smogon, and make sure you take some time to read the global rules.

-

Congrats to the winners of the 2023 Smog Awards!

(Any Kind of) Investment in Nintendo

- Thread starter Professor Birch

- Start date

nobody is going to shell out for 3dses once the new systems come out in five years. that's a horrible investment. collecting them may be a fun recreational activity, but it's not an investment and you shouldn't tell yourself otherwise.

also, at your age it's not a bad idea to put the money you would waste on like ten shares of nintendo in a certificate of deposit. it may not have the promise of a pie-in-the-sky, ultralucrative payout like the stock market does on television but it's safe, has a better interest rate than an ordinary savings account, and you won't regret it.

also, at your age it's not a bad idea to put the money you would waste on like ten shares of nintendo in a certificate of deposit. it may not have the promise of a pie-in-the-sky, ultralucrative payout like the stock market does on television but it's safe, has a better interest rate than an ordinary savings account, and you won't regret it.

Does the value on limited edition systems really depreciate that much now?I've been collecting and reselling games for 2 years now and judging by trends of older DS and gameboy systems a regular 3DS will be worth about 30-40 dollars in 5 years whereas a limited edition would be worth 30-75 (depending on rarity). So you won't be making profit.

A good example I could give you is the NES edition SP which is the most sought after (not necessarily rare) SP in existence, it goes for around 60-70 loose and closer to 100 boxed. If you plan on doing this anyway make sure you keep the boxes!Does the value on limited edition systems really depreciate that much now?

I didn't plan on opening them at all actually. Any tips you could give to try an earn some profit?A good example I could give you is the NES edition SP which is the most sought after (not necessarily rare) SP in existence, it goes for around 60-70 loose and closer to 100 boxed. If you plan on doing this anyway make sure you keep the boxes!

I actually disagree.nobody is going to shell out for 3dses once the new systems come out in five years. that's a horrible investment. collecting them may be a fun recreational activity, but it's not an investment and you shouldn't tell yourself otherwise.

also, at your age it's not a bad idea to put the money you would waste on like ten shares of nintendo in a certificate of deposit. it may not have the promise of a pie-in-the-sky, ultralucrative payout like the stock market does on television but it's safe, has a better interest rate than an ordinary savings account, and you won't regret it.

More security is a better decision for older folks, but generally younger people should try to invest I'm stocks.

The keys are time and diversification. Look at any 20-30 year span of the American stock market, and it's clear the trend is upwards and pretty stable. People who have 30-40 years to invest should start with stocks and move to safer investments in time-- though this also assumes that you have the capital to invest in enough diversity. Diversity is essential to reduce risk. Mutual funds are a way to get diversity without the capital base to invest in a diversity of individual stocks.

Keep in mind though that the Japanese stock market does not have the same historical stability as the US...

It's gonna take probably some 50 years (yeah throwing out random numbers, but you get the point) before you probably get any decent return if you're going with like collectible systems. How common they are also plays a role; for example, you can still pick up say an original Atari for dirt cheap depending on condition, and even mint ones probably don't command that very high of a price because they were so common. On the other hand, you can make a pretty quick buck buying one of those limited anniversary PS4s and flipping it (and flipping new game consoles in general, at least successful main gen ones).

But regardless, you're dealing with both a fickle and niche market here, if you want better and more immediate returns, you'd be better off with more traditional investment vehicles like stocks/bonds over volatile collectibles. Remember Beanie Babies? Yeah...

But regardless, you're dealing with both a fickle and niche market here, if you want better and more immediate returns, you'd be better off with more traditional investment vehicles like stocks/bonds over volatile collectibles. Remember Beanie Babies? Yeah...

I know you're a banker so I'll concede you're probably right in general, but if you take a look at nintendo in particular the stock price is the almost same as it was in 1999. the only big spike is from 2006-2008, which can be attributed to the wii's ubiquity. contrast with 2012-2014, the same period for the wii u. it was not a home run, and it shows. however, there has been hilariously enough a spike in price that coincides with the remakesI actually disagree.

More security is a better decision for older folks, but generally younger people should try to invest I'm stocks.

The keys are time and diversification. Look at any 20-30 year span of the American stock market, and it's clear the trend is upwards and pretty stable. People who have 30-40 years to invest should start with stocks and move to safer investments in time-- though this also assumes that you have the capital to invest in enough diversity. Diversity is essential to reduce risk. Mutual funds are a way to get diversity without the capital base to invest in a diversity of individual stocks.

Keep in mind though that the Japanese stock market does not have the same historical stability as the US...

sry im kinda rambling but HI CHOU HOPE UR LIFE IS GOIN GOOD, BELATED CONGRATS ON HAVING AN OFFSPRING

Yea but if I buy let's say now, I have plenty of time to wait for a spike to happen. If that never happens, I should at least break even. I wouldn't really know much but it seems to me that Nintendo is a stable company and therefore, will generally end up at the same price.I know you're a banker so I'll concede you're probably right in general, but if you take a look at nintendo in particular the stock price is the almost same as it was in 1999. the only big spike is from 2006-2008, which can be attributed to the wii's ubiquity. contrast with 2012-2014, the same period for the wii u. it was not a home run, and it shows. however, there has been hilariously enough a spike in price that coincides with the remakes

sry im kinda rambling but HI CHOU HOPE UR LIFE IS GOIN GOOD, BELATED CONGRATS ON HAVING AN OFFSPRING

You would do much better by putting that same money that you put into Nintendo into a plain vanilla index fund tracking the entire stock market. Nintendo has several long term challenges ahead that would scare me as a long term investor. How does Nintendo compete against Microsoft / Sony? What about the cheaper gaming alternatives from the likes of Apple's app store? Can Nintendo really continue to survive off of Mario / Zelda / Pokemon / Smash Bros remakes? Idk it seems to me that I would rather put my money elsewhere.Yea but if I buy let's say now, I have plenty of time to wait for a spike to happen. If that never happens, I should at least break even. I wouldn't really know much but it seems to me that Nintendo is a stable company and therefore, will generally end up at the same price.

being at the same price now as in 1999 isn't the same as keeping the same value due to inflation. $1 usd in 2014 is worth about $0.70 usd in 1999.Yea but if I buy let's say now, I have plenty of time to wait for a spike to happen. If that never happens, I should at least break even. I wouldn't really know much but it seems to me that Nintendo is a stable company and therefore, will generally end up at the same price.

Cresselia~~

Junichi Masuda likes this!!

Reselling Japanese Pokemon cards to Western people sometimes work.

But does not work if you keep them for ages. You sell within months after you get them.

Try asking little kids (the ones who are noobs) to trade you the tool cards, and then re-sell it on the internet.

I knew someone who earned lots by buying Rare Candy from kids and re-sell on the internet.

But there's one condition-- you have to travel between Asia and the West quite often (for example, being a foreign student) , and you have enough luggage space to take the cards with you.

People don't like to pay for shipping, and neither do you.

But does not work if you keep them for ages. You sell within months after you get them.

Try asking little kids (the ones who are noobs) to trade you the tool cards, and then re-sell it on the internet.

I knew someone who earned lots by buying Rare Candy from kids and re-sell on the internet.

But there's one condition-- you have to travel between Asia and the West quite often (for example, being a foreign student) , and you have enough luggage space to take the cards with you.

People don't like to pay for shipping, and neither do you.

Agreeing with the person who suggested index fund if the OP wants to invest in something relatively safe and actually get some return unlike a CD which gets you pretty much nothing once you account for inflation. Index fund is the easiest. Invest in the good times. Buy cheap in the bad times. Keep piling it up. If it looks like shit is about to hit the fan or you're starting to lose uncomfortable amounts, dump everything into bonds.

If OP doesn't have the income then playing stocks is unnecessarily dangerous and risky. Though buying Nintendo could just be a cool learning experience as nintendo isn't gona do anything anyway.

@OP If you wana buy and sell Nintendo stuff, don't get discouraged. You can flip stuff you have good knowledge of on ebay and make your self some extra money. It'd be something fun and the fact that you can make a little cheddar makes it rewarding. Better than buying and holding on to them for the long-term because, best case scenario, they won't appreciate much if at all IMHO.

If OP doesn't have the income then playing stocks is unnecessarily dangerous and risky. Though buying Nintendo could just be a cool learning experience as nintendo isn't gona do anything anyway.

@OP If you wana buy and sell Nintendo stuff, don't get discouraged. You can flip stuff you have good knowledge of on ebay and make your self some extra money. It'd be something fun and the fact that you can make a little cheddar makes it rewarding. Better than buying and holding on to them for the long-term because, best case scenario, they won't appreciate much if at all IMHO.

Nonononono. Do not invest in collectables.I'm pretty young(in my opinion) to be thinking about investing, but honestly, I feel that the earlier you make a smart choice, the earlier it can come back to help you. Over the summer I recently invested a good amount of money(from my perspective) into the Stock Market for Nintendo. And now, I really want a new hobby or thing to do, so I came and mixed two things that I find interesting/worthwhile. Still need to get approval from my parents to do it(I'm only 16), but I want to collect Limited Edition 3DS systems. I love just looking at all the designs and my hope is that I'll be able to turn that into profit after selling them in years to come. Since I did not find a thread relating to this already created, let us discuss investing in Nintendo!

Backstory: People thought that these stupid stuffed animals would appreciate in value (it was a bubble) such that they could send their kids to college on the profits.

You're young; invest in equities (stocks). To avoid trading fees, try to move your money around as seldom as possible. Invest in what you know, but keep in mind that just because you like something doesn't mean the market will. I wouldn't touch Nintendo with a 40-foot pole even though I love most of their products; their market is being taken over by crappy phone games on the low end and other consoles/PC gaming on the high end. Perplexingly, (to me) analysts really like the whole Amiibo thing; this is because even though they're basically action figures that

If you know Nintendo's business model (low production cost, curated software platform, kid-friendly, exclusive IP) and can stomach the risk, I'd keep some money in NTDOY. Buuut it's risky, not even considering the vicissitudes of the Japanese stock market.

It probably wouldn't be a bad idea to diversify outside of video games/software in case consumer tastes shift from video games to something else.

Bit of a disclaimer: this isn't financial advice as I'm not a financial advisor. Just some food for thought.

My 2c.

I think Cho pretty much explained the basics.

However, you probably don't have a lot of money to spend (I don't know how rich your parents are, but at 16, I was pretty broke and not investing in a lot of shit), so I'd say :

- Have fun, but don't think you're playing casino, you won't double what you invested after one year or anything like that

- Spread your investments, even if the amounts are really low. The point is to have "fun", basically, if you invest 10$ in Nintendo, no matter how meaningless these 10$ are, you'll still be "interested" in how they perform. So I think high diversification is a pretty good thing to do, as it's both funny, and healthy for your investment. Obviously, it means that you should first understand what is the point of diversification : lower the risk. For that you need to build a coherent portfolio, I invite you to study a little bit the basics of market finance, just so you don't build up a retarded portfolio.

- Talking about healthiness, I think what you're trying to do is a very healthy hobby, it'll keep you interested in the company's news, and that's really cool, even though you're a bit young for that. You'll probably notice then that Nintendo looks like a really crappy investment, especially from a strategical point of view, as they're threatened from every fucking angle.

- Focus on making low profits, as silly as it sound, act like you're playing a game. However it's important to win this game, make sure your % growth is at least higher than the inflation (this is your first objective), and keep improving it step by step. You're not playing a guessing game at all, market finance is all about mathematical concepts that I think you can grasp by starting safe, and then trying to move forward, little step by little step.

So yea, basically try to diversify as much as you can, try to put your interest above your personal bias and make a check up at least every month, and a conclusive statement at the end of the year.

PS : For the second-hand market, forget about it, you need to be very patient, the prices are really high, and then they go really low... only to growth slowly towards their real prices. There are a couple of rare gems whose prices skyrocket after some years, but these are definitely not 3DS systems. It's way too recent anyway, I really don't see the point, I don't even think that the second-hand price of these things will ever be close to today's prices. Now if you're talking about the Net Present Value of such investment... I think you'll be grealty disapointed.

On the other hand, buying a WindWaker game, a Baiten Kaitos one etc.. is a really SAFE investment, that you can actually enjoy, the prices of these second-hand games have already been through the down spikes, and are only enhancing. Not only you'll be enjoying these games, but on top of that, you're guaranteed to sell them back for a better price later.

Can you do it with a dozen of 3DS ? I don't think so.

So yea, buy a SNES, and invest in games, you'll have a lot of fun and you'll be winning money, that's the perfect gaming investment in my opinion (or you can emulate, but that's less funny, and you won't be selling back ROMS right?).

I think Cho pretty much explained the basics.

However, you probably don't have a lot of money to spend (I don't know how rich your parents are, but at 16, I was pretty broke and not investing in a lot of shit), so I'd say :

- Have fun, but don't think you're playing casino, you won't double what you invested after one year or anything like that

- Spread your investments, even if the amounts are really low. The point is to have "fun", basically, if you invest 10$ in Nintendo, no matter how meaningless these 10$ are, you'll still be "interested" in how they perform. So I think high diversification is a pretty good thing to do, as it's both funny, and healthy for your investment. Obviously, it means that you should first understand what is the point of diversification : lower the risk. For that you need to build a coherent portfolio, I invite you to study a little bit the basics of market finance, just so you don't build up a retarded portfolio.

- Talking about healthiness, I think what you're trying to do is a very healthy hobby, it'll keep you interested in the company's news, and that's really cool, even though you're a bit young for that. You'll probably notice then that Nintendo looks like a really crappy investment, especially from a strategical point of view, as they're threatened from every fucking angle.

- Focus on making low profits, as silly as it sound, act like you're playing a game. However it's important to win this game, make sure your % growth is at least higher than the inflation (this is your first objective), and keep improving it step by step. You're not playing a guessing game at all, market finance is all about mathematical concepts that I think you can grasp by starting safe, and then trying to move forward, little step by little step.

So yea, basically try to diversify as much as you can, try to put your interest above your personal bias and make a check up at least every month, and a conclusive statement at the end of the year.

PS : For the second-hand market, forget about it, you need to be very patient, the prices are really high, and then they go really low... only to growth slowly towards their real prices. There are a couple of rare gems whose prices skyrocket after some years, but these are definitely not 3DS systems. It's way too recent anyway, I really don't see the point, I don't even think that the second-hand price of these things will ever be close to today's prices. Now if you're talking about the Net Present Value of such investment... I think you'll be grealty disapointed.

On the other hand, buying a WindWaker game, a Baiten Kaitos one etc.. is a really SAFE investment, that you can actually enjoy, the prices of these second-hand games have already been through the down spikes, and are only enhancing. Not only you'll be enjoying these games, but on top of that, you're guaranteed to sell them back for a better price later.

Can you do it with a dozen of 3DS ? I don't think so.

So yea, buy a SNES, and invest in games, you'll have a lot of fun and you'll be winning money, that's the perfect gaming investment in my opinion (or you can emulate, but that's less funny, and you won't be selling back ROMS right?).

Last edited:

What's the point in diversifying when he's not gona invest much at all to start with.

OP unless you're a finance stud and thoroughly understand valuation, I do NOT recommend messing with stocks. No professional portfolio manager can stay consistent and actively invest, what makes you guys think it's a great idea to suggest to the OP to do so?

If you wana save yourself the headache and make a fair return the simplest and MOST effective way you can do so as a (presumably) amateur investor is the index fund. A monkey can profit using an index fund. It's also the cheapest in terms of fees.

Warren Buffett agrees with me on index funds: http://www.businessinsider.com/warren-buffett-recommends-sp-500-index-2014-3

Invest in the index. Use the rest of your saved capital for flipping and messing around with Nintendo stuff.

OP unless you're a finance stud and thoroughly understand valuation, I do NOT recommend messing with stocks. No professional portfolio manager can stay consistent and actively invest, what makes you guys think it's a great idea to suggest to the OP to do so?

If you wana save yourself the headache and make a fair return the simplest and MOST effective way you can do so as a (presumably) amateur investor is the index fund. A monkey can profit using an index fund. It's also the cheapest in terms of fees.

Warren Buffett agrees with me on index funds: http://www.businessinsider.com/warren-buffett-recommends-sp-500-index-2014-3

Invest in the index. Use the rest of your saved capital for flipping and messing around with Nintendo stuff.

What's the point in diversifying when he's not gona invest much at all to start with.

Why don't you read the god damn posts instead of asking ?

OP unless you're a finance stud and thoroughly understand valuation, I do NOT recommend messing with stocks. No professional portfolio manager can stay consistent and actively invest, what makes you guys think it's a great idea to suggest to the OP to do so?

If he wants to have fun with his spare money, as long as he's not being risky, there is no reason to panic..... he's not investing his pension so I don't know why you want to stop him from trying. He's not trying/able to risk/win big anyway.

Why "mess", lmfao, you can learn the simple basics, and be able to invest safely yourself, it's not that complicated. Why are you talking about professional portfolio manager ? Is he a broker ? Will he be fired if he doesn't reach a certain amount of benefits ?

????

?

???????

Worst case scenario he loses 20% of 100$ over a year and learns a lot out of the experience. Don't play the whistleblower role, the stakes aren't that high anyway.

If you wana save yourself the headache and make a fair return the simplest and MOST effective way you can do so as a (presumably) amateur investor is the index fund. A monkey can profit using an index fund. It's also the cheapest in terms of fees.

That's the whole point, we don't want him to be a monkey.................. there are things you can only learn by getting your hands dirty a little

Warren Buffett agrees with me on index funds: http://www.businessinsider.com/warren-buffett-recommends-sp-500-index-2014-3

Invest in the index. Use the rest of your saved capital for flipping and messing around with Nintendo stuff.

It's good if you're old and have a a decent amount of sleeping money, yea, sure, which is not the case

Last edited:

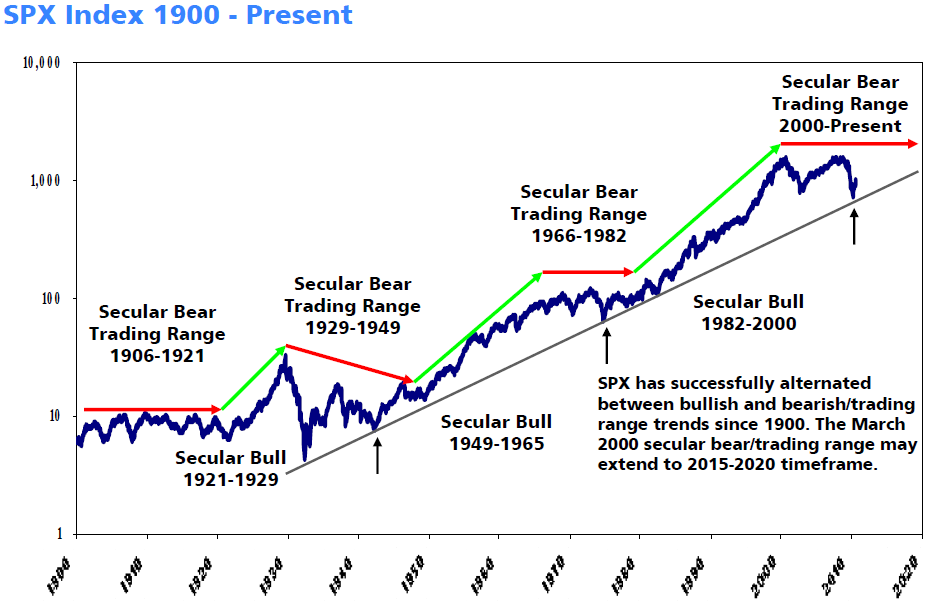

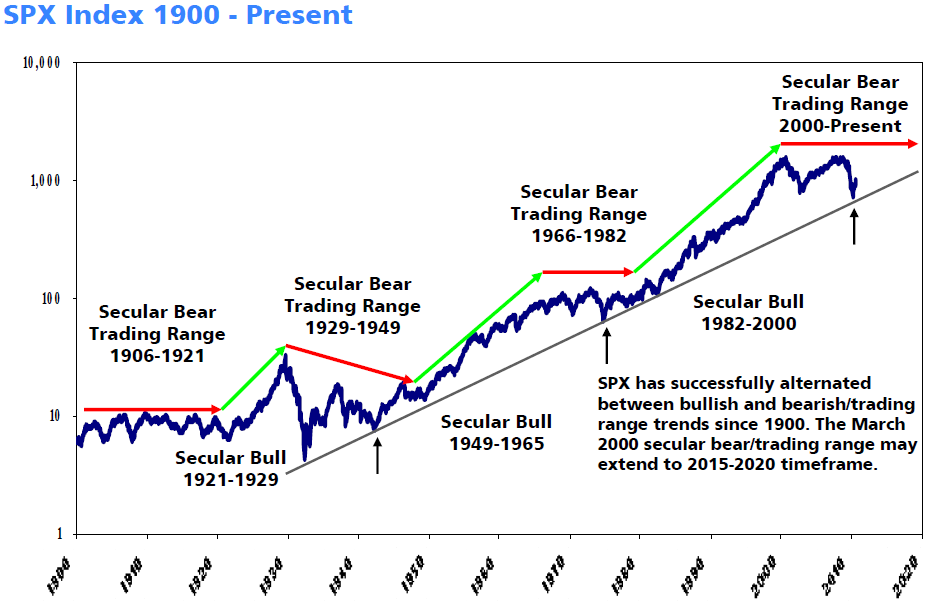

OP is less than 20, and will presumably live to 60+ (especially with medicine advancing).What's the point in diversifying when he's not gona invest much at all to start with.

OP unless you're a finance stud and thoroughly understand valuation, I do NOT recommend messing with stocks. No professional portfolio manager can stay consistent and actively invest, what makes you guys think it's a great idea to suggest to the OP to do so?

Nice chart and all, but what does this have to do with whether to buy stocks? I see a nice long trend upwards with bumps along the way, and that is exactly what I expect will happen with stocks in my lifetime. Whether we are in a "secular bear" is meaningless since there are not many good places for OP to invest his money. Stocks are fine. Pokemon cards are not.OP is less than 20, and will presumably live to 60+ (especially with medicine advancing).

Even for stocks, I wouldn't mind investing in one stock and researching it to see why it's a good buy. You would learn a ton that way. I just would suggest something other than Nintendo. Or indexing is fine. Your choice.

I don't care about the labels, was just illustrating the historic movement of the S&P.Nice chart and all, but what does this have to do with whether to buy stocks? I see a nice long trend upwards with bumps along the way, and that is exactly what I expect will happen with stocks in my lifetime. Whether we are in a "secular bear" is meaningless since there are not many good places for OP to invest his money. Stocks are fine. Pokemon cards are not.

Even for stocks, I wouldn't mind investing in one stock and researching it to see why it's a good buy. You would learn a ton that way. I just would suggest something other than Nintendo. Or indexing is fine. Your choice.

If you read my post, you'd see I was responding to the nay-Sayers of stocks in general.

The point is simply that it's wise for younger people to invest in stocks-- though holding long positions and importantly diversifying is key.

I'd agree with buying the index itself as a good bet-- looking at mutual funds is a way to get diversity that I mentioned.

@v I'm not a banker, but a marketer actually... I'm only speaking from a handful of finance courses (though mostly corporate finance, not individual wealth management) and a bit of common sense, so feel free to agree or not. I just wouldn't advise people to try to put off young folks in investing in stock in general.

Ah, understood. I thought that's what you were getting at but the labels threw me off.I don't care about the labels, was just illustrating the historic movement of the S&P.

If you read my post, you'd see I was responding to the nay-Sayers of stocks in general.

The point is simply that it's wise for younger people to invest in stocks-- though holding long positions and importantly diversifying is key.

I'd agree with buying the index itself as a good bet-- looking at mutual funds is a way to get diversity that I mentioned.

@v I'm not a banker, but a marketer actually... I'm only speaking from a handful of finance courses (though mostly corporate finance, not individual wealth management) and a bit of common sense, so feel free to agree or not. I just wouldn't advise people to try to put off young folks in investing in stock in general.

Ah, my bad, my bad. Sorry on that--Ah, understood. I thought that's what you were getting at but the labels threw me off.

PC+++

I am the same age as OP and I was wondering what you guys think of treasury bills at our age. Imo it looks like a fairly decent investment at our age because the T-Bills are very liquid and allow our money to grow more than they would if they it was just sitting in a savings account. So basically what do you guys think about Treasury Bills and do you think they are worth investing in or should we look into something else?

Reymedy

How is a moderator allowed to respond so crudely? I thought this place had a bit of class. Just because your idea sucks and would do WORSE than buying a simple index fund doesn't give you green light to respond like you're 100% correct on a subjective topic.

The point of investing is not to have fun you jackass, it is to make money. There is nothing funny about it. Some people understand value of money. You need to be careful what you recommend. You say is he gona be a broker?! Then you suggest he actively invests and makes monthly statements.

Also you point out he's not old and isn't saving for retirement. He's young. He has time. That's the formula for building wealth with index. Look at Chou's graph. If the op were to add money to an index each month he'd amass a nice chunk of change and would secure his own future.

Your ideas are good. Don't trade often, cut costs, spread the risk. But in his case it's not practically useful. The money he would spend on load fees and online broker costs would eat all of his profits since he wouldn't be investing much to start with. The only reason for him to invest in stocks would be as a learning experience. Just to start an account he'll need $500+. I don't know where you're getting this cute idea that he might invest 100 bucks and lost 20%. Add in your broker fees and load fees and you can go ahead and mark that up to 30%+ loss.

Investing in stocks makes sense when you have money to invest AND money to lose. IMHO if you've got 100K in cash then yeah playing stocks makes sense. Playing stocks with small amounts of money is just a waste of time.

BanSpecsMachamp

There's no (real) return in short-term T bills. They're better than savings account but you won't really grow your money.

How is a moderator allowed to respond so crudely? I thought this place had a bit of class. Just because your idea sucks and would do WORSE than buying a simple index fund doesn't give you green light to respond like you're 100% correct on a subjective topic.

The point of investing is not to have fun you jackass, it is to make money. There is nothing funny about it. Some people understand value of money. You need to be careful what you recommend. You say is he gona be a broker?! Then you suggest he actively invests and makes monthly statements.

Also you point out he's not old and isn't saving for retirement. He's young. He has time. That's the formula for building wealth with index. Look at Chou's graph. If the op were to add money to an index each month he'd amass a nice chunk of change and would secure his own future.

Your ideas are good. Don't trade often, cut costs, spread the risk. But in his case it's not practically useful. The money he would spend on load fees and online broker costs would eat all of his profits since he wouldn't be investing much to start with. The only reason for him to invest in stocks would be as a learning experience. Just to start an account he'll need $500+. I don't know where you're getting this cute idea that he might invest 100 bucks and lost 20%. Add in your broker fees and load fees and you can go ahead and mark that up to 30%+ loss.

Investing in stocks makes sense when you have money to invest AND money to lose. IMHO if you've got 100K in cash then yeah playing stocks makes sense. Playing stocks with small amounts of money is just a waste of time.

BanSpecsMachamp

There's no (real) return in short-term T bills. They're better than savings account but you won't really grow your money.